What if I told you there’s an auto insurance company that processes claims faster than a speeding bullet? Imagine having your claim settled before you can even brew a cup of coffee. Welcome to the surprisingly speedy world of fast insurance settlements.

In today’s frantic pace of life, waiting around for a slow insurance payout is a luxury few of us can afford. This is why uncovering the fastest claim-paying auto insurance companies is a game-changer. You won't believe how quick some of these providers are, and how they stack up against the slowpokes.

Here’s a little-known surprise - the conventional wisdom around big insurance brands being sluggish is being turned on its head. Some of the largest companies have invested millions into technology to expedite claim processing and customer satisfaction has skyrocketed. Most people think the behemoths drag their feet with claims, but that’s not even the wildest part…

Smaller companies, on the contrary, are often assumed to be nimbler due to their size, but some can actually be slower in claim processing due to limited resources. The myth that the little guys always win in speed is being debunked as we speak. But hang tight, because this isn't the most surprising part…

What happens next shocked even the experts. Auto insurance companies are utilizing artificial intelligence and machine learning to accelerate processes beyond human capability. Could this tech really be the future of insurance claims? Because what you’re about to discover may just turn everything you knew about auto insurance on its head.

Artificial intelligence is more than just a buzzword; in the auto insurance world, it's the secret weapon that’s changing the landscape. Insurers using AI are slashing claim processing times by sifting through data faster than any human could. The result is a sooner-than-expected settlement hitting your account, which is something drivers everywhere can celebrate.

With algorithms capable of analyzing accidents in real-time, even the investigation stage has gone on a diet down to hours instead of days or months. These machines learn from each interaction, becoming sharper, quicker, and more accurate over time. But there’s one more twist…

Insurance companies are not just stopping at claim procession efficiency; they’re actively predicting the likelihood of accidents and adjusting their risk assessments accordingly. Such proactive measures mean they can better buffer risks, ensuring faster payouts when the unfortunate does occur.

This ever-evolving technology landscape means the industry might soon see a world where claims are processed on auto-pilot, and customer interactions are reduced to lightning-fast resolutions. What you read next might change how you see this forever.

The average time to process a claim with traditional methods was around 30 days. However, brands infused with cutting-edge tech are cutting this metric dramatically, leaving those sticking with the status quo struggling to keep up.

A staggering 75% of the fastest payouts happen with insurers who’ve embraced digital platforms. These systems not only expedite the paperwork but also increase transparency, allowing clients to track their claims in real-time, minimizing anxiety and frustration.

For those involved in minor accidents, some companies now offer claims processing within 24 hours. The days of waiting while your vehicle sits in the repair shop are becoming a relic of the past, offering not just peace of mind but actual peace of time back to the insured.

This trend towards rapid resolutions is growing, and guess who’s quietly pushing the envelope? Could the traditional giants be the newfound speedsters in this space? It’s a race you didn’t even know you were watching. Don’t look away now, because the rabbit is making its comeback.

It’s not just about speed; affordability still reigns king in insurance decisions. But can you get both speed and value? Surprisingly, many low-cost insurers, once notorious for sparse customer service, are now leading the charge in fast claims.

Take Acme Insurance, traditionally seen as a bare-bones option, now fine-tuning their digital services to offer 3-day claim resolutions without upping premium prices. Their affordability paradox has even regulators raising eyebrows.

Meanwhile, Tele-Ensure is deploying virtual adjusters to slash costs and streamline claim checks, passing the savings onto customers without cutting corners on service or speed. Want fast claims without emptying your wallet? It might be time to reassess where you're putting your faith, and dollars.

What happens when the cheapest becomes the most efficient, blending quick payouts with unbeatably low premiums? It's enough to shake the foundations of conventional consumer wisdom, making us rethink everything we thought we knew.

Contrary to popular belief, many of the larger insurance operators have begun leveraging their vast resources to outpace smaller contenders in claim payouts. Their deep pockets allow them to invest in the latest technologies and hire skilled professionals to manage complex claims without delays.

This means that if your bumper is crunched or your ride stops running, opting for a big name might just mean a hassle-free resolution before you even realize it. These operations are increasingly resembling finely-tuned machines, pumping out settlements with efficiency and ease.

So, while the giants were traditionally seen as cumbersome and slow-moving, in this new era, their weight has become a distinct advantage, ensuring rapid settlements for their clients at a staggering pace.

Are we witnessing the rise of the insurance titans once again? As you digest these revelations, it's tempting to imagine a world where the David-and-Goliath story turns on its head—prepare to be amazed by more unexpected transformations.

With the power of processing speeds in the limelight, insurers are more motivated than ever to cater to their customers’ desires—not just to respond quickly but also to do so effortlessly. Personalized policies and tailored interactions are becoming central to the insurance experience.

New tools in the digital arsenal are making sure of this — chatbots that handle preliminary claim details, apps that guide policyholders through each step, and feedback loops that continually enhance service through customer input.

This means that repairs, replacements, and reimaginings of the insurance policy are fluid, flexible endeavors, supremely suited to each individual's lifestyle and rhythm. Convenience is being woven into the very fabric of insurance offerings.

But what does this mean for the traditional phone-and-fax approach? As innovative companies pivot to a customer-first paradigm, insurance is morphing beyond recognition, leaving us to wonder what could possibly come next.

In today’s world, customer reviews wield unprecedented influence. For insurers aiming to thrive in a competitive space, listening to user feedback has never been this crucial. Responses to online reviews can drastically shape an insurer’s public perception.

Insurers that actively engage with their customers post-claim, addressing grievances or leveraging feedback to bolster operations, surprisingly, report more rapid growth in their customer bases. It's transparently handling missteps that makes clients more likely to stick around.

What’s remarkable here isn't just how reviews influence perception but how they drive real change internally. As public feedback becomes louder and more immediate, responsiveness turns into a key differentiator and accounts for rising satisfaction metrics across various brands.

As user feedback shapes the speed and quality of services, could traditional customer service be in for a radical transformation? The power of shared experiences could very well dictate the future path of the insurance industry.

It’s no longer solely about the tools—an essential piece to the fast-pay puzzle is the people. Meticulously trained personnel, equipped with the know-how and tenacity to expedite resolutions, are the unsung heroes behind swift insurance payouts.

Many leading firms are investing heavily in training programs, honing abilities to effectively balance empathy with efficacy, ensuring personnel are as prepared as their digital counterparts to manage speed-centric claims.

Efficient training doesn’t merely provide a strong foundation for expeditious service—it also breeds an environment where employees thrive, motivated by the real impact their roles have on customer lives. This symbiosis is a significant asset, boosting satisfaction on both ends.

But with training comes complexity; are these firms truly meeting this challenge head-on? As we peer deeper, the strategies and outcomes are more engaging than you might expect. Prepare to delve into the human aspect of this industry transformation.

When sweeping changes occur, there’s often more than meets the eye. Insurance giants have quietly invested in cognitive computing, their secret weapon for seamless and almost instantaneous processing times.

This technology combines massive data crunching with human-like interaction capabilities, rendering traditional bottlenecks obsolete and opening doors to an era powered as much by psychology as by digital prowess.

Bringing in the cognitive edge, insurers refine their predictive abilities, not only expediting claims but foreseeing and mitigating issues before they escalate. Sweetening the deal for policyholders who seek peace of mind along with quick turnaround.

Are we standing on the cusp of a revolution where empathy and AI join hands to serve customers better? The complexity unravels further as we explore these transformative advancements and what they imply for the future of auto insurance.

While the U.S. insurance market often leads with examples, international trends offer intriguing comparisons. In some regions, ultra-fast payouts are already seen as the norm, thanks to stringent regulations demanding speedier resolutions to claims.

Seeing how other countries blend innovation with regulation offers fresh insights. For instance, in Japan and parts of Europe, there's a blending of telematics and AI to not only deliver speedy conclusions but create smarter, fairer policies too.

This global view underscores a truth often overshadowed: insurance isn’t just an economic necessity; it’s a universal service shaped uniquely by mosaic markets worldwide. And every locale brings forth a fresh perspective that enriches the global dialogue.

Could neighboring strategies inform domestic breakthroughs? As we cross borders in our exploration, be prepared for revelations that transcend geographical limitations while enriching the very essence of rapid insurance services.

Speed isn’t merely an operational advantage—it also bears environmental dividends. By reducing claim processing times and cutting down on resource-intensive processes, insurers are indirectly lowering carbon footprints and operational waste.

Streamlining claim cycles generally means fewer physical resources consumed in processing demands, fewer instances of unnecessary replacements, and more sustainable, informed decisions driving resource allocations.

This eco-conscious angle contradicts traditional narratives, adding more than just speed to the value proposition of swift claim settlements while subtly making waves in insurer reputations and consumer choices.

Will environmental accountability soon demand higher priority in customer decision criteria? What does this shift signify for how we evaluate and choose insurance services? Look deeper into how green thinking is steering the wheels of this industry towards a responsible future.

A well-educated customer is an empowered one. As attention spans shrink, insurers are creatively instilling vital insurance knowledge, aiding policyholders in decisions that will fulfill their claims with unprecedented quickness and clarity.

Simple yet effective educational campaigns, focusing on the digital landscapes customers already inhabit, are proving far more adaptable and far-reaching than any dense policy document could achieve.

Through these efforts, choice and clarity are being democratized, assisting consumers in grasping finer details of policy terms that once felt daunting and archaic. These educational shifts expedite informed, efficient claim interactions.

As information becomes as accessible as air, how do these newfound wellsprings of understanding influence consumer habits? It's an educational evolution you didn't see coming, rich with subtleties and surprises yet to unfold.

Technological prowess has disrupted many industries, and auto insurance is no exception. With tech advancements, new contenders are entering the arena, challenging old norms with nimble operations and novel customer experiences centered around convenience and speed.

App-based startups are targeting customers who aspire for user-friendly, rapid claim services. These disruptors attract tech-savvy generations, banking on ease, transparency, and customer empowerment through data.

The ripple effects of these players in the market showcase a shifting dynamic, as traditional firms must adapt faster than ever to uphold relevance and compete against this wallet-friendly, high-speed insurance race.

Could this disruption mean the end of the insurance archetype as we know it? With change sweeping at breakneck speeds, the landscape is transforming faster than most could imagine. Is your policy keeping up with the times?

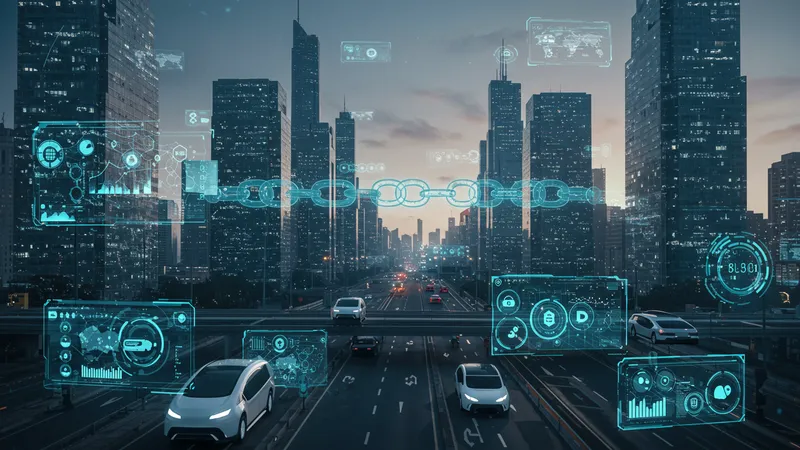

As we forge ahead, what lies beyond today’s fast-paced claim settlements? Experts suggest further integration of AI and big data will continue refining efficiencies, with pay-as-you-drive schemes already taking root as a means to personalize and regulate premium expenses.

Beyond AI, blockchain technology is being eyed as a tool for transparency and decentralization, potentially revolutionizing how claims are processed and policies are accessed by consumers eager for control over their data and decisions.

This wave of transformation promises more than fast payouts; it embodies a higher degree of consumer independence, choice, and technology-enhanced experiences. A brave new world for insurers and policyholders alike.

In a landscape so rich with possibilities, what innovations lay waiting on the horizon? Journey with us as we unveil more about how these impending shifts could reshape insurance forever. Prepare for a roadmap to an insurance world filled with endless potential.

As the curtain falls on our exploration of claim payout speed dominance, we're left with valuable insights. It's a call to fundamentally rethink our approach to insurance—prioritizing nimble claims, technology, and eco-conscience, aligned with crisply educated consumers.

Now is the moment to evaluate your policy not just on cost but also on efficiency. Share your experiences, connect with providers, and push the dialogue forward. It’s in collective voices that the future of this industry finds direction and new vigor.

Spread the word: a fast-forward world demands insurance that keeps pace with our speed-racing lives. Encourage those around you to rethink parameters, to consider insurance not just as a necessity but as a tailored, rapid-service ally in the bustling rhythm of modern life.

Could tomorrow's insurance hold unexpected, daring innovations we have only glimpsed? In this era of change, you hold the power to shape what’s ahead. Are you ready to take the wheel, steer into the future, and set new standards? Fasten your seatbelt; this ride is just beginning.