Did you know there's a bank offering savings account returns that could outpace inflation? Yes, you read that right! This isn't your ordinary piggy bank — we're talking interest rates that are shaking up the financial world.

With economic uncertainty looming, it's crucial to find secure yet profitable places for your money. High-yield savings accounts have never been more relevant, catering to those wanting safety and smart growth simultaneously.

You might think that your current bank rate is decent, but here's the surprising truth: most traditional banks offer paltry interest. While big names dazzle with branding, they often underperform in savings. Few realize how accessible these high-yield options have become. But that’s not even the wildest part…

Consider this: some accounts even rival short-term investment returns without the risk. It’s a paradise for conservative investors who need liquidity plus earnings. Stories abound of individuals transforming their financial future by simply switching accounts. But wait until you hear who else this benefits…

What happens next shocked even the experts: a financial shift with the potential to redefine American savings. Ready to unravel the unexpected? Keep reading because this is only the beginning!

Would you believe that traditional banks are reluctant to advertise these high-yield savings accounts? The reason is quite simple yet shocking: profit margins. While offering negligible interest rates on savings, these banks use your deposits to fund higher-interest loans, making billions in the process.

This gap is crucial to understanding why high-yield options are kept on the down-low. The lesser-known online banks leverage fewer overhead costs to offer superior rates to savvy customers. It's a big win for those in the know, though mainstream institutions remain silent.

Imagine finding out your funds could have been tripling in growth last year had you switched early. It’s a sobering thought, yet a real financial opportunity lies within your grasp. But there’s one more twist you might not anticipate…

These high-yield accounts are also pushing traditional banks to innovate, shaking up an industry that's been stagnant for decades. As customers demand more bang for their buck, expect future banking reforms inspired by these digital disruptors. What you read next might change how you see this forever.

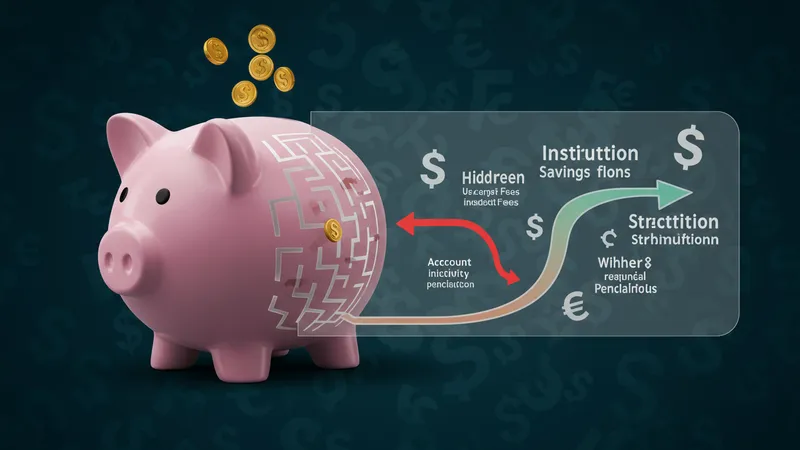

It's not all roses and sunshine in the world of high-yield savings accounts. While they boast higher returns, some come with unexpected fees. From account inactivity fees to withdrawal penalties, these hidden costs could chip away at your anticipated earnings.

But it’s worth noting, several financial institutions have designed these products with transparency in mind, reducing user friction by minimizing ancillary fees. Remember, understanding and comparing terms is as critical as the interest rate itself.

Nonetheless, a small withdrawal penance is a price many seem willing to pay for the lucrative benefits high-yields provide. This isn't just your usual bank tactic. It's about balancing immediate financial needs with long-term fiscal strategy.

What you read in your next scroll might just demystify the cons and expose if there's more than what meets the eye. But brace yourself: there's an even bigger picture unfolding here…

Think high-yield savings accounts are strictly for older generations or wealthy individuals? Think again! Millennials and Gen Z are dominating the shift towards smarter savings, attracted by the flexibility and accessibility online banks provide.

As these tech-savvy cohorts disrupt financial norms, credit high-yield savings as their cornerstone for generating wealth without investing in volatile markets. The narrative has shifted — investing is no longer the sole path to financial growth.

These accounts allow unprecedented financial freedom: saving for a future anywhere, at any time, without complex barriers. It's the sort of grassroots-level finance management that's modernizing independent fiscal futures.

This reverberation is just the start. What comes next might surprise you about how universal access impacts even unexpected demographics. But the next revelation will flip conventional wisdom on its head…

While banks are no strangers to tech integration, it's in the high-yield savings landscape where technology truly excels. AI-driven insights are helping customers stay informed, track goals, and maximize capital gains effortlessly.

Moreover, fintech innovations allow these accounts to offer superior security and lower fraud attempts than traditional savings. It's about staying one step ahead, ensuring clients feel safe while getting better returns on their investments.

But that’s not the only benefit - automation takes out the guesswork. Suggested plans, intelligent alerts, and more: all available at your fingertips, creating the ideal synergy between tech and traditional finance.

If you thought the perks stopped there, wait until you hear how future tech might push these savings to even greater heights. What happens next might just redefine what we've come to expect from financial institutions…

It's not the banks alone driving high-yield savings' popularity; there's a governmental stake involved too. Did you know that many policy changes are subtly aiding online banks to thrive? Increasing public digital savviness is in federal interest!

These institutions smartly leverage tax incentives and regulatory relaxations, helping provide those inviting returns that allow innovations to flourish. It's a clever, mutually beneficial relationship between regulation and the free market.

Yet, it's a silent progression. You're not hearing it shouted from rooftops by the Treasury but pay close attention, and the wheels are noticeably in motion. The intertwining of bureaucracy and modern banking remains a game-changer.

Let’s delve even deeper to uncover the extent of our governments’ quiet, yet pivotal, contribution. But what unfolds next might just revolutionize your perception of modern fiscal ecosystems.

Ever wondered why some high-yield savings accounts vary vastly in performance, even outdoing stocks and bonds? The secret lies in specialized financial strategies tailored for high-growth yet safe liquidity.

By tactically investing in diversified financial products, these savings accounts can sometimes outperform typical market fluctuations — a safer bet when compared to the volatile swings of stock investments.

But remember, it requires keen knowledge of pursuing correct yields. Aside from conveniently keeping cash accessible, parking funds in these savings offers an impressive avenue for growing capital steadily.

Still curious about what sets these mavericks apart from other players in the financial arena? What you learn next might ignite your curiosity to explore beyond conventional portfolios.

Faced with the rising tides of high-yield savings accounts, big banks are not standing idle. From strategizing competitive rates to acquiring thriving fintech enterprises, they've entered a competition frenzy.

Customer loyalty programs and tier-based systems witness an uptick as banks scramble to not just retain but grow their clientele base. It’s a fascinating dance of tradition meeting innovation.

The underlying strategy? Balancing stability with innovation. Integrating novel financing models has been their focus, aiming to rewrite the narrative of what traditional banking means today.

But what's still left for them to do to keep their influence intact? Stay tuned to discover another dimension of this ongoing financial epic…

High returns are enticing, but it's essential to consider the risks associated with high-yield savings accounts. There’s a chance of fluctuating rates, as returns can significantly vary depending on market interest changes.

Consequently, individual money management plays a pivotal role. Going all-in on your savings might seem tempting, but it’s crucial to keep a diversified approach for optimum financial health.

Being aware of fee structures and any potential liquidity issues is key to safeguarding your assets while capitalizing on high yields. Informed decisions today forge stronger monetary foundations tomorrow.

What if the potential benefits outweigh the pitfalls in unique circumstances? The next insight could change how you perceive these options forever.

As ever-changing interest rate policies and inflation trends make headlines, their influence on high-yield savings can't be overlooked. Rising rates can spell enhanced savings growth.

Yet, sensitive savers must be cognizant of macroeconomic trends. Even subtle shifts can jar APYs, transforming victorious gains into minor adjustments on expected returns.

Following economic forecasts capitalizes on opportunity windows that favor progressive savers. Keeping abreast with insights leads to better navigation of fiscal landscapes.

This strategy ensures nimble adaptability across economic cycles. But next, there's more to unwrap concerning emerging trends that set the scene for high-yield futures.

Among those who champion high-yield accounts, a significant contrast exists: savers prioritize liquidity and safety, while investors lean towards risk and dividends. But, the lines blur amidst evolving personal goals.

Emotional motives largely drive savings behavior — particularly post-2020 uncertainties. Converting conventional safety nets to growth avenues bolsters both financial confidence and security preferences.

Still, the emergence of hybrid financial products that cater to savers-turned-investors reflects the changing paradigms in wealth management aspirations.

Does this signify a new way of financial thinking? Our exploration continues with a look at how these dynamics are reshaping fiscal landscapes today.

Never underestimate the universal reach of social media in influencing financial decisions. Digital platforms play powerful roles, disseminating information, reviews, and comparisons at lightning speed.

The online world creates an educated demographic diligently chasing the best financial deals. Viral stories of fortunes made or educations funded spark widespread engagement.

However, it’s vital to discern trustworthy facts from digital noise. It requires savvy discernment as an overloaded information ocean can toss novice savers, steering strategies or mindsets.

Ready for more revelations? We'll dive deeper into just how pivotal digital intersections are changing financial traditions.

Nothing beats authentic stories of ordinary individuals experiencing extraordinary changes through high-yield accounts. Heartfelt testimonials provide both inspiration and unique insight.

From recent graduates building wealth to retirees securing seamless income streams, countless narratives highlight the transformative power of well-chosen savings strategies.

But personal stories are more than mere motivation; they provide evidence, networking cues, and strategies for those still deciding their financial paths.

Such impactful accounts open doors to wider conversations, but there’s another layer of experiences still waiting to be explored beyond these pages.

The conversation around financial personalization isn’t slowing. Tailored high-yield accounts could soon outweigh cookie-cutter solutions, catering distinctively to each user’s savings goals and risk appetite.

Beyond grid-like structures, personalized finance strategies are emerging, demanding innovation — blending app data, analytics, and customer insights into unprecedented savings experiences.

These custom solutions offer greater engagement, leading to empowered decision-making and ultimately, smarter financial concepts.

Don’t believe bespoke finance will shape tomorrow? Discover what unlocks next as individualized, thoughtful approaches to savings revolutionize banking.

By embracing this knowledge, you're poised at the forefront of a financial renaissance — seizing potential that many still overlook. There's power in not only knowing but sharing these insights.

Spread the word, bookmark this revolution, and align yourself with these burgeoning opportunities today. It might just redefine your financial tomorrow.