You've been doing it all wrong: the investment strategy for 2025 isn't just about stocks and bonds. There's a whole new world of opportunities that even seasoned investors are missing out on. Are you ready to uncover the secrets?

Amid geopolitical shifts and post-pandemic economic recovery, investing smartly is hitting unprecedented importance. The landscape is evolving, and you can't afford to lag behind. Get ahead before it's too late!

You might think traditional investments are secure. But get this: the energy sector, which seemed to promise stability, now shows vulnerabilities as sustainable alternatives gain traction. Solar power investments surged by 45% last year, upending expected norms. But that’s not even the wildest part—venture capitalists are re-aligning, backing unexpected sectors.

Surprisingly, luxury real estate is seeing unanticipated growth. Despite economic downturns, high-net-worth individuals are doubling down on multi-million-dollar estates. What draws them? Tax benefits and currency hedges. But here’s the shocking twist: this isn't exclusive to the elite. Digital platforms now democratize access, shaking up age-old investment pillars. The implications of this trend are enormous…

Your financial future is at a crossroads. What happens next shocked even the experts—don't miss why this could be the single most pivotal year for your investment portfolio. Click through and keep reading to uncover the tools and strategies that could transform your asset growth!

In the past, diversification meant spreading your investments across a range of industries. However, a surprising trend is emerging: tech-heavy portfolios are outperforming traditional ones. With the rapid growth of AI and machine learning, companies like Apple and Google are transforming sectors beyond just technology. Investors who take the plunge are witnessing returns that traditional stocks can’t match. But there’s one more twist waiting to be unveiled.

Insider trading scandals have plagued the tech industry, yet this hasn't deterred ambitious investors. Astonishingly, some individuals profit from the very volatility these controversies create. They use specially designed algorithms to anticipate stock drops, buying low and reaping rewards as stocks stabilize. It’s a risky maneuver but backed by strategy and unprecedented access, ordinary people are making extraordinary gains. But that's only half the story…

Startups in the electric vehicle arena offer another lucrative avenue. Rivals to Tesla, like Rivian and NIO, are catching investor attention, posting exponential revenue jumps that are forcing traditional automakers to rethink their strategies. The EV boom isn't just about car sales—it's an entire ecosystem of battery technology and charging solutions. But the most intriguing part is…

Communities are rallying around these innovations, creating unexpected synergies between tech investments and environmental impact. This convergence is something no serious investor should overlook, especially with governments incentivizing eco-friendly industries. What you read next might change how you see investment strategies forever. Dive deeper to discover industries you’ve never considered that are poised to skyrocket.

An unlikely hero in the investment world is emerging, and it might surprise you: sustainable agriculture. As consumers become more conscious about where their food comes from, companies focused on sustainable practices are reaping profits. The demand for organic and locally sourced food continues to rise, offering investors stable and lucrative opportunities. But there’s more beneath the soil…

Beyond plant-based farming, there’s a growing interest in alternative protein sources, such as lab-grown meat and insect farms. These industries are in their infancy yet promise explosive growth. Major fast-food chains are testing these products, and initial results show promising consumer acceptance. This is not just another trend; it’s a market shift capable of reshaping the global food industry. But wait, there’s another curiosity in store…

Hydroponics and vertical farming are no longer just hobbies for tech enthusiasts; they are becoming viable commercial ventures. By growing vegetables indoors using minimal water, these methods address not only food security but also environmental needs. Investors are noticing tangible benefits, with some experiences double-digit returns in a relatively short span. And that’s not the most exciting part…

The integration of AI in agriculture offers unprecedented efficiency and productivity. From smart sensors that analyze soil quality to drones that aid in crop management, the technological advancements in farming are astounding. These innovations are creating a fertile ground for investments, nurturing global prospects. Could this be the breakthrough the industry’s been waiting for?

If you think physical property is the only lucrative real estate investment, think again. Digital real estate is rewriting investment rules. Virtual spaces, domains, and blockchain-based land are attracting serious attention—and serious money. A .com domain can sell for millions while virtual spots on platforms like Decentraland see fierce bidding wars, showing unexpected potential. The rabbit hole only deepens as you explore further…

The metaverse concept, evolving beyond a buzzword, presents a universe of investment opportunities. As businesses rush to claim their piece of virtual real estate for branding and customer engagement, values skyrocket. Savvy investors recognize the untapped potential here, witnessing appreciation rates unheard of in physical real estate. But what surprises even insiders is…

Non-fungible tokens (NFTs) continue to expand horizons. From art and music to virtual characters and real estate, NFTs are proving to be more than a fad. Investors are buying shares in digital assets with unprecedented ownership rights, altering the perception of value creation in the digital age. However, a startling twist remains…

With looming regulatory frameworks, many expect challenges, yet potential loopholes offer intriguing ways to navigate this new territory. As laws struggle to catch up with innovation, the brave who enter this realm early may unlock unforeseen rewards. Dive into the next stage of our journey and be prepared to rethink your investment portfolio forever.

Beyond Bitcoin and Ethereum, a slew of altcoins and blockchain applications are cropping up, offering unique investment angles. These innovations are tackling issues from banking to energy consumption with intriguing efficiency. Decentralized finance (DeFi) protocols, in particular, present staggering returns for early adopters. But brace yourself for the unseen dimensions of crypto…

Despite inherent volatility, some tokens possess unprecedented resilience. Take stablecoins for example; pegged to fiat currencies, they offer a striking stability, forging trust in crypto marketplaces. This dual nature of stability and innovation draws investors from traditional finance sectors. But there’s an unexpected undercurrent at play…

Crypto staking offers another avenue, providing passive income for holders who choose to lock their coins. Meanwhile, bridges to real-world applications flourish—smart contracts, notably, streamline transactions across industries, from insurance to real estate. The scope of integration is vast and loaded with potential yet the real revelation hides beneath the surface…

Increasingly, countries are embracing digital currencies, leading geopolitical shifts in monetary policy. Central bank digital currencies (CBDCs) are on the horizon, bringing legitimacy and mainstream adoption closer. What you discover in the following section could redefine your understanding of how digital currencies integrate into our economic systems.

The pandemic exponentially accelerated biotechnology advancements, which now offer profound investment opportunities. From personalized medicine to gene editing, biotech innovations promise returns unlike traditional pharmaceuticals. Consider CRISPR gene-editing stocks—they doubled last year, signifying the transformative impact in healthcare. There’s a deeper exploration to be had…

Biotech’s appeal extends beyond treatments. Diagnostic companies experience a boom, driven by preventive health services and at-home testing kits. The demand for these is soaring, reshuffling how healthcare is delivered worldwide. Investors keenly watch these trends unfold. But there’s an incredible twist you need to know…

Innovations like mRNA technology extend beyond vaccines, offering potential in cures for chronic illnesses such as cancer. The breakthroughs here are profound with colossal implications for global health outcomes. The possibilities are almost limitless, yet the industry harbors a curious secret…

Companion diagnostics, tools that predict treatment efficacy for individuals, are moving from experimental to mainstream use. Investors in these technologies stand at a pivotal intersection of tech and health. As you continue reading, prepare to uncover a whole new landscape of investment possibilities that could recalibrate your portfolio strategy forever.

Holistic health approaches, traditionally sidelined in favor of pharmaceuticals, are capturing mainstream focus. The global wellness industry, valued over $4 trillion, exceeds GDPs, and alternative medicines represent a substantial slice. From CBD products gaining legal footing to herbal remedies receiving scientific validation, a paradigm shift is underway. Yet, there’s an even more fascinating shift…

Investment in psychedelic research for mental health marks a burgeoning frontier. With promising outcome studies, companies exploring these treatments attract serious investor capital. Psychedelic therapies hold potential to disrupt conventional mental health practices profoundly. But that isn't the only unexpected growth driver…

Eastern medicine practices like Ayurveda and TCM are seeing scientific investigations tie centuries of tradition with contemporary validation. Their global expansion companies offer robust portfolios ripe for diversification. But a surprising element in this sphere is unfolding…

Wellness tourism is witnessing unprecedented expansion. Investors are banking on retreats and resorts focused on healing, yoga, and mindfulness that continue to thrive in an ever-stressed world. The shift towards holistic well-being suggests an economy prioritizing treatment over cure, altering investment strategies. Discover more in the upcoming shift that might transform market dynamics.

Real estate investing is notoriously capital intensive—until now. Crowdfunding platforms like Fundrise and RealtyMogul allow individuals to pool money for larger property investments, democratizing an investment once reserved for the wealthy. Surprisingly, they yield returns comparable to traditional REITs but with added value peculiarities. Want to know what these are? Keep scrolling…

Some crowdfunding projects offer dual benefits—ownership stakes along with income from property appreciation. Such structures create diversified risk in portfolios that are otherwise asset-heavy. With fractional ownership spreading, markets are noticing lengthier investment horizons. Yet there’s a wild card investors shouldn't ignore…

Urbanization trends benefit properties in secondary cities, often overlooked by major real estate players. While the main markets capture headlines, these smaller markets realize faster appreciation percentages—creating hidden prospects for vibrant portfolios. The knowledge about these emerging hubs could reshape where the savviest investments go. And that's not all…

The intersection of tech and real estate doesn’t stop at crowd-funding. Implementations of smart technology in buildings boost their value, making them hot targets for forward-thinking investors. As cities embrace smarter infrastructures, our next sections reveal the impact on investment considerations you may have never thought about.

Education Technology (EdTech) is experiencing an unprecedented boom as remote learning redefines how we think about access to education. Platforms like Coursera and Udemy bridge educational gaps, garnering significant investments. But beyond course offerings, what other exciting facets drive this sector's growth?

AI-driven personalized learning tools identify student strengths and weaknesses, adapting content to fit individual needs. These innovations aren’t merely improving education—they're reshaping how we view knowledge dissemination itself. And believe it or not, this shift is just the tip of the iceberg…

Gamification in learning is a powerful tool attracting investors by promoting engagement through interactive experiences. Consider Roblox’s expansion into educational games—this isn't merely entertainment; it is developing skills through playful exposure. There's a further compelling piece to this educational puzzle…

Blockchain technology promises to revolutionize credentialing systems, offering immutable records for skills and qualifications. As institutions and businesses adapt, investors in such tech find themselves at the crux of groundbreaking educational reforms—reforms that are just getting started. What comes next could revolutionize global training and education paradigms forever.

Mass production is giving way to the age of personalization, leading to a renaissance in niche markets. Bespoke products and services cater to increasingly discerning consumer bases, creating fertile ground for investment. Surprisingly, hyper-customization isn’t confined to luxury—it's accessible, practical, and growing rapidly. But wait until you delve deeper...

Subscription services that offer tailored products, from skincare to meal kits, are redefining consumer relationships, providing value through personalized experiences. As niching intensifies, these curated offerings reveal unexpected opportunities for recurring revenue streams. Yet, there’s an even richer layer to explore…

Personalized financial services are transforming how people manage wealth. Robo-advisors deliver tailored investment solutions once exclusive to private banking clients. As DIY finance takes hold, the demand for sophisticated tools fuels substantial market expansion. But unearthing another jewel could alter your outlook…

Consumer demand for custom-fit technology, such as wearables calibrated to an individual's data, forecasts vast investment potential across health and lifestyle sectors. With personalization becoming the new norm, understanding consumer data is more crucial than ever, opening venues that few investors considered before. Exploring these dimensions might just redefine how you approach p markets.

The travel industry sees unprecedented shifts post-COVID, with trends departing from convention to embrace a new norm. Remote working spurs extended stays, reshaping the tourism landscape. Places once sidelined are emerging as new hotspots, brands transforming their portfolios in unexpected ways. But this is just scratching the surface…

Eco-tourism experiences explosive growth, driven by consumer consciousness towards sustainability. Travel companies are laser-focused on reducing carbon footprints while offering unforgettable, Instagram-worthy adventures. These greener pathways provide novel avenues for investment not earlier foreseen. What lies beneath is even more intriguing…

Regenerative travel takes eco-tourism a step further by improving destinations through tourism itself. This emergent trend is gaining popularity, focusing investments on creating beneficial, sustainable growth opportunities. Finding such investments could determine a post-COVID strategy's success. But that’s only the beginning…

Technological advancements in traveling—from biometric check-ins to blockchain in ticketing—create a new travel experience with increased efficiency and safety. Such tech promises industry-wide transformations, making efficient handling an attractive investment to manage evolving consumer needs. Prepare for an upcoming section that will lay out how these transformations match up with dynamic market expectations.

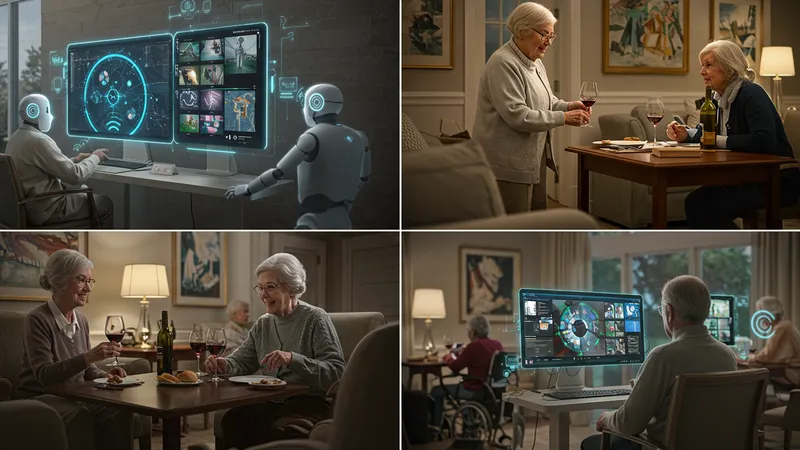

With an aging population, senior living facilities are evolving, incorporating technology to enhance quality of life. Robotics, telehealth, and smart homes offer seniors independence while ensuring safety, attracting enthusiastic investors. Yet, the more that changes, the more there is left to explore…

Technology isn’t the only disruptor; lifestyle-focused communities are sprouting, catering to the interests and hobbies of seniors. From wine tasting to art, these curated lives generate robust demand, creatively reimagining retirement living. But more astonishing shifts continue developing in this sector…

Alternative accommodation models, like home-sharing and intergenerational living, redefine traditional perceptions of senior care. These ideas leverage nostalgia and community support, fostering meaningful interactions while efficiently maximizing space and resources. The implications for property and service investments remain profound, but we’ll explore further in our ensuing slides…

Technological integration in healthcare through AI and predictive analytics offers insights beyond what was achievable before. It changes how preventative care is administered, leading to longer, healthier lives, driving interest and funding in health-focused tech startups. This revelation is just the starting point for investors tracking these burgeoning markets.

Renewable energy investment seems straightforward, yet it houses unexpected complexities—hydrogen power, for example, is on the cusp of solving critical storage challenges, promising revolutionary industry shifts. As utilities converge towards sustainable power, innovations unfold that will amaze even seasoned investors…

Energy efficiency is no longer confined to industrial scales; home solutions see dramatic innovations. Smart insulation and grid-integrated home systems offer substantial savings and new investment verticals, piquing interest for creating greener home spaces. Continue to discover an even bigger role for emerging technologies…

Microgrids designed for resilience draw attention for capability in mitigating power losses amidst extreme weather. Their usage signals a decentralized future, where investments in localized solutions offer unexpected diversification. Rampant adaptation heightens prospect exploration…

Public policies sway these energy markets, with favorable regulatory frameworks propelling solar and wind investment into new territories. The attraction of tax rebates and government incentives for clean energy spurs exciting developments for eco-focused portfolios. Witness the transformational steps await on this evolving terrain, adapting to meet climate goals and redefine energy investment landscapes.

As you’ve just seen, today's investment opportunities are as varied as they are exciting. With ongoing digital, ecological, and social shifts, understanding the complex interplay between politics, technology, and economics is more pivotal than ever. Let these insights guide your financial strategies.

As we stand at the precipice of new economic epochs, it’s time to act. Bookmark this page, share these revelations, and undertake the due diligence to navigate your investment journey in 2025 and beyond. The strategies you've explored could be your map to prosperous returns. Dive in and redefine what it means to invest smartly!