Did you know that more than 50% of families are left financially vulnerable when the primary earner passes away suddenly? Discover how term insurance plans can be your family’s financial shield!

With the current economic uncertainty, safeguarding your family’s future is crucial. More people than ever are turning to term insurance plans as a reliable safety net—but that’s just the tip of the iceberg.

You might assume that all term insurance plans are created equal. But contrary to popular belief, the flexibility and benefits of these plans vary dramatically. Some plans offer the ability to convert into permanent insurance, offering lifelong protection. However, choosing the wrong plan can leave gaps, preventing you from getting the most out of your money. But that’s not even the wildest part…

Consider this: Term insurance isn’t just about covering expenses. It’s an investment in peace of mind. Imagine knowing your loved ones are protected from debt, mortgages, or even future tuition fees. Surprisingly, some options allow you to customize policies to include specific coverages like critical illness or income protection. There’s a burgeoning trend with term insurance riders that you simply can’t ignore. But what happens next shocked even the experts…

It’s not just a death benefit — term insurance brings a myriad of underappreciated advantages that often go unnoticed. Few realize that these plans can serve as income replacement, ensuring your family’s lifestyle is maintained even in your absence. For a seemingly old concept, term insurance is reinventing itself as a must-have asset. But there’s one more twist…

Imagine taking control over your policy. Flexible plans are more prevalent than ever, allowing adjustments according to major life changes like marriage or childbirth. This adaptability is a game-changer, as it aligns with life's unpredictability, making term insurance more relevant than ever. Yet, developments in this field are still surprising many.

There are tools available for estimating future needs, associated with evolving term insurance trends. These tools ensure that your coverage grows alongside inflation and living costs, safeguarding your family against economic downturns. If you think you’re prepared for what’s next, prepare to be surprised by a twist that flips everything on its head.

The rise of technology has introduced new agents and insurance portals that make purchasing term plans a breeze. With just a few clicks, you can compare dozens of policies to find what suits your unique needs. Even the process of claim settlement has become surprisingly swift and convenient. What you read next might change how you see this forever.

Many remain unaware of the power that riders bring to term insurance plans. Riders are additional benefits that enhance your basic policy. A common yet overlooked rider is accidental death. While many think basic coverage is sufficient, this rider offers up to triple the coverage in case of an unforeseen accident, making it an eye-opener for skeptics.

Waiver of premium is another under-the-radar benefit. Should you become disabled, this rider ensures premiums are paid, and coverage continues. It’s a safety net that adds value to your policy, taking a significant worry off your shoulders. But wait, there's a catch…

Riders can also include critical illness coverage, granting a lump sum amount if diagnosed with life-threatening illnesses like cancer or heart disease. This provision gives a policy an edge, turning it into a valuable asset. However, managers warn against pitfalls when stacking too many riders; they could inflate costs and complexity without proportional benefits.

The final hidden gem is the return of premium rider. If the policyholder survives the term, the total premium paid is refunded. This feature transforms term insurance into a pseudo-savings plan, appealing to those skeptical of insurance value. Each rider presents a strategic choice, one that few examine under a spotlight. But it's time to reveal more secrets as we turn the page.

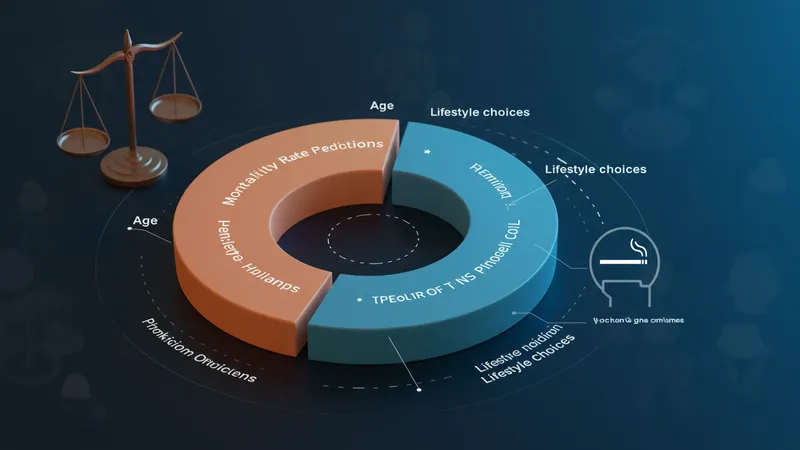

At first glance, term insurance appears budget-friendly, but understanding its cost can be perplexing. The seemingly low premium for high coverage is enticing, but what lies beneath? The primary driver is mortality rate predictions, which determine the premium cost. Revealing this model exposes the industry's workings like never before.

Price variations do exist, heavily influenced by age, health condition, and lifestyle. Smokers, for instance, pay substantially more due to elevated health risks—up to 200% higher premiums, in fact. It ignites a debate on whether such disparities are justified or a means to capitalize on lifestyle choices.

However, savvy consumers know there's more to explore. Discounts and incentives for healthy living habits are increasingly common. They reward short-term sacrifices with long-term savings. But navigating these discount terms is an art that few master, often missing out on slashed premiums.

The notion of cost also ties into inflation concerns. Where dollar inflation eats into potential savings, adjusting coverage for inflation ensures policy relevance over time. Some argue it “future-proofs” your investment. But is that enough? Trust us, the next revelation may just redefine how you perceive term insurance planning.

A common quandary: how long should your term insurance last? Many default to shorter terms, considering their perceived lower cost, but are they missing out? Extended term durations often carry benefits that outweigh their price tag.

Adopting a longer term can mean fixed premiums for double or triple the time, guarding against rate hikes. Through a long-term lens, higher premiums now could mean substantial savings later. It’s a matter of perspective and planning that surprisingly few embrace.

People frequently underestimate the probability of needing insurance in their later years. A longer term policy secures peaceful retirement years, ensuring that you can maintain coverage without negotiating expensive new plans as age advances.

Policy conversion options are typically open for longer durations, permitting a grace period to switch to a plan that better suits changing needs. It’s akin to holding a conversion option for your assets; something experienced financial advisors enthusiastically support. The surprising ramifications of choosing between long and short terms warrant a deeper consideration.

Major life events constantly reshape our needs and priorities, but many neglect to update their term insurance policies accordingly. Did you know that over 30% of life insurance holders admit they've never updated their policies post-major life changes?

A marriage, the birth of a child, or purchasing a home can significantly alter financial obligations. Failing to adjust your coverage could leave gaps in protection—an oversight with potentially dire consequences, especially when every dollar counts.

Conversely, post-divorce or when children become financially independent, policyholders may need fewer benefits. Adjusting policies in these cases can save money. Few, however, take advantage of this flexibility, bogged down by misconceptions of insurance's rigidity.

Understanding how to accurately reflect your current situation in your policy proves invaluable. With modern-day insurance allowing updates with minimal hassle, it's a shift from past complexities. Ignoring these updates is akin to ignoring your car’s maintenance; only trouble can follow. The revelations to come will make you rethink what you assume to know.

While term insurance might appear as a stodgy financial product, it’s ironically becoming the face of innovative technology in financial services. What was once a manual, paper-draped process is swiftly transitioning into a digital-first experience.

AI algorithms now personalize insurance plans, assessing risk based on a wide swath of data—ranging from health metrics to spending habits. This new frontier allows for rates that are fine-tuned with staggering precision, leaving traditional underwriting in the dust.

Digital platforms have also sprouted up, making comparison shopping for insurance a painless, informed process. One can now assess and secure policy options online, bypassing brokers and their commissions, leading to significant savings.

However, with new tech comes skepticism. The pace and data used in underwriting decisions mystify even seasoned insurance professionals. But with payoffs and reduced premiums on the line, this is a technology boom worth welcoming—and it's only set to grow more complex.

Exploring the term insurance marketplace can feel like getting lost in a sprawling maze. The sheer volume of information—policies, riders, premiums—bewilders many, with some ultimately giving up pursuing what they need most.

Knowing where to begin can untangle the chaos. Seek trusted comparison portals that align options based on personalized financial considerations, enabling an efficient discovery process. It's akin to having a compass in a tangled forest of choices.

Understanding intermediary roles—such as brokers or agents—informs decisions that are often swayed by hidden biases or commissions. Distinguishing unbiased advice can protect your interests from those pursuing a commission-centric agenda.

The market itself is a flux of change, offering new features and plans regularly. Keeping tabs on market trends is essential to ensure your policy evolves parallel to these innovations. Missing the market boat means potentially overwhelming your finances. Now, the landscape is fraught with exciting new pathways ripe for exploration.

Beyond financial protection, a term insurance plan offers psychological comfort that shouldn't be underestimated. Knowing your family's future is secure provides invaluable peace of mind—a sentiment overlooked by those fixated on numbers alone.

Securing a term plan isn’t just a financial decision; it’s a commitment to responsibility. This psychological assurance aids as much in reducing anxiety about the unknown as a tangible safety net across life’s unpredictable landscape.

The relief extends beyond the policyholder, permeating family and future beneficiaries. It fosters a sense of togetherness, alleviating familial tensions, assuring that loved ones are not left vulnerable amidst unexpected events.

While some find the perception of preparing for death unsettling, embracing protection transforms fear into empowerment. It offers a psychological resilience that rivals any fiscal prognostication, making it a prized component of holistic wellness. This isn't just about preparation—it's about redefining protection itself.

Many fall victim to persistent myths surrounding term insurance, such as the notion that it’s an unnecessary expense for the healthy. This misconception overlooks insurance's primary function: preparing for the unpredictable.

Then there's the belief that costs always outweigh potential benefits. Many assume surviving the term negates having the insurance, but the peace of mind it provides is priceless—knowing you’ve acted in your family’s best interest is undeniably rewarding.

Having multiple plans for different needs is often misunderstood. Many fear policy overload, yet stratifying your investments can efficiently protect varied aspects of life itself, covering gaps specific to personal circumstances. It's a pragmatic approach in a complex world.

The aversion toward discussing mortality leaves many uninformed of valuable options until it’s too late. Addressing this taboo shifts conversation to one of cautious preparation, transforming what is feared into what is cherished. This pivot in thought may save much more than just finances.

Who knew term insurance plans come with compelling tax benefits? Surprisingly, many policyholders overlook this key advantage on both ends: premiums paid and benefits received.

Premiums can typically be deducted under specific tax codes, providing potential immediate savings and easing annual financial burdens. Yet, knowledge of these deductions remains curiously underdispersed among the general public.

Payouts upon maturity or in the event of a claim are often received tax-free, a boast few other savings instruments can match. This renders term insurance a smart fiscal choice beyond its immediate purpose.

Figuring out how to integrate insurance into tax planning transcends basic saving strategies, presenting an opportunity to maximize financial health. Understanding these nuances can profoundly affect personal finance strategy, often in overlooked, underestimated ways.

Choosing the right term insurance policy requires an artful blend of current and future considerations tailored to personal circumstances. Individual needs nearly always trump a 'one size fits all' approach in insurance planning.

Identifying core requirements—whether it’s covering liabilities or funding children's education—guides policy customization best suited to distinct family dynamics. Assessing prospective burdens shapes decisions otherwise clouded by broad generalizations.

Comprehensive plans with convertible options ensure flexibility, an essential factor in an ever-changing personal landscape. The assurance of adapting to life’s shifts should never be underestimated in importance.

Crafting a robust policy demands ongoing vigilance. Reviewing coverage ensures alignment with evolving goals through life's seasons, offering assurance that your plan remains in lockstep with your journey. Yet, many ignore these routine check-ins, leading to unforeseen gaps or missed opportunities that demand reevaluation.

Customer support in term insurance often plods along in obscurity, unnoticed until urgently required. When financial operations grow complex, having a responsive support network is as pivotal as selecting the right policy itself.

Great customer service clarifies dense insurance jargon, expediting processes that often confuse even seasoned policyholders. A lack of support can lead to missteps that cost money and peace of mind.

Support teams also mediate claims efficiently, with streamlined processes that differentiate stellar insurance entities from lackluster competitors. These interactions can salvify the outcome of a crisis, transforming chaos into resolved calm.

Many insurers now leverage AI chatbots and 24/7 support hotlines, ensuring accessibility never wanes, delivering transparency without transactional disruptions. This tech-driven evolution beckons a future where peace of mind accompanies every policy purchase. Never before has it been this pivotal—and rewarding—to connect meaningfully with your provider.

In the complex world of term insurance, where every detail conceals waves of change, unraveling these truths can reshape your financial future. From bewildering policy selections to surprising tech advancements, this insurance avenue challenges perceptions while championing prudence and preparation. Turn this newfound insight into action: secure, review, and confirm your path to fortified family protection. Share this guide to expand informed conversations on term insurance planning's undoubted future-proof capacities. Together, let’s spread the truth: your family's future isn’t a gamble—it's an assurance waiting to be uncovered.